Charity Care and Partial Charity Care Discount Policy

Mission

AHMC Healthcare Inc. (“AHMC”) and its affiliated hospitals are committed to excellence in providing quality health care services to our communities with a team of compassionate and dedicated professionals, within a culturally rich and ethically appropriate environment.In order to better serve the community and further our mission, the AHMC hospitals will accept a wide variety of payment methods and will offer resources to assist patients and responsible parties in resolving any outstanding balance. The hospitals will treat all patients equitably, with dignity, respect and compassion, and, wherever possible, help patients who cannot pay for all or part of their care.

AHMC recognizes that there are unfortunate occasions when a patient is not able to pay for their medical care, and in such situations we at AHMC will adhere to applicable Federal, state, and local law. In this connection, the hospitals have established guidelines pursuant to which patients may apply and, as appropriate, qualify for, charity care or partial charity care (including a discount payment plan).

Purpose

The purpose of this policy is to define the eligibility criteria for charity care and partial charity care assistance and provide administrative guidelines for the identification, evaluation, classification, and documentation of patients’ accounts as charity care or partial charity care. The AHMC hospitals will ensure that these policies are effectively communicated to those in need, that we assist patients in applying and qualifying for known programs of financial assistance, and that all policies are accurately and consistently applied.Furthermore, the AHMC hospitals will define the standard and scope of services to be used by our outside agencies that are collecting on our behalf, and we will obtain this agreement in writing to ensure that our policies are adhered to throughout the entire collection process.

Definitions

Charity Care means 100% free medical care for services provided by the AHMC hospitals. Patients who are uninsured for the relevant, medically necessary services, who are ineligible for governmental or other insurance coverage, and who have family incomes not in excess of 200% of the Federal poverty level will be eligible to receive Charity Care.Federal health care program means any health care program operated or financed at least in part by the Federal government.

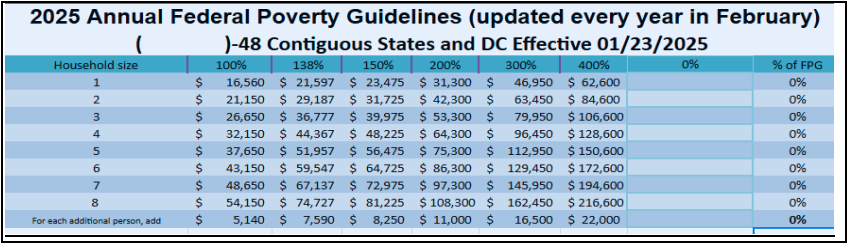

Federal poverty level means the poverty guidelines updated periodically in the Federal Register by the United States Department of Health and Human Services under authority of subsection (2) of Section 9902 of the United States Code.

Partial Charity Care means care at a discount rate for services provided by the AHMC hospitals. Patients who are uninsured or patients with high medical costs for the relevant medically necessary services and who have family incomes in excess of 200%, but not to exceed 400%, of the Federal poverty level, will be eligible to receive Partial Charity Care in the form of a discount off inpatient and/or outpatients charges. The discounted payment policy shall also include an extended payment plan to allow payment of the discounted price over time (which payment plan shall be interest free). Expected discounted payment for services shall not exceed the amount that the hospital would expect, in good faith, to receive for providing services from Medicare, Medi-Cal, the Healthy Families Program, or another government-sponsored health program of health benefits in which the hospital participates, whichever is greater.

Patient’s family means: (1) for persons 18 and older, spouse, domestic partner, and dependent children under 21 (whether living at home or not); and (2) for persons under 18, parent, caretaker relatives, and other children under 21 of the parent or caretaker relative.

Patient with high medical costs means a person whose family income does not exceed 400% of the Federal poverty level, and for this purpose high medical costs means either of: (1) annual out-of-pocket costs incurred by the patient at the AHMC hospital that exceed 10% of the patient’s family income in the prior twelve months; or (2) annual out-of pocket expenses that exceed 10% of the patient’s family income, if the patient provides documentation of the patient’s medical expenses paid by the patient or the patient’s family in the prior twelve months. NOTE: A patient with high medical costs can include a person who receives a discounted rate from the hospital as a result of third-party coverage.

Self-pay patient means an individual who does not have any third-party health care coverage from either: (a) a third party insurer, (b) a Federal health care program, (including without limitation Medicare, Medi-Cal, California Children’s Services program, Healthy Families Program and TRICARE), (c) workers’ compensation, (d) medical saving accounts, or (e) other coverage, for all or any part of the bill, including claims against third parties covered by insurance to which the AHMC hospitals are subrogated, but only if payment is actually made under such insurance.

Policy

The AHMC hospitals are committed to treating uninsured patients and patients with high medical costs who have financial needs with the same dignity and consideration that is extended to all of its patients. The AHMC hospitals consider each patient’s ability to pay for his or her medical care and, as appropriate, extend Charity Care or Partial Charity Care to eligible patients. This policy is intended to implement and fully comply with applicable Federal, state, and local laws (including without limitation California Health and Safety Code Section 127400 et seq.) and any regulations promulgated thereunder (collectively, “Applicable Law”), and shall be construed in such manner as to do so. In the event of any inconsistency between the provisions of this policy and mandatory provisions of Applicable Law, the provisions of Applicable Law shall apply. Where provisions of this policy are different than those mandated by Applicable Law, but are nonetheless permitted by Applicable Law, the provisions of this policy shall control.

Responsibilities of AHMC Hospital to Communicate With Patients

Each AHMC hospital will have a means of communicating the availability of Charity Care and Partial Charity Care to all patients.

Patients will be provided with a statement that if the patient does not have health insurance coverage the patient may be eligible for Medicare, Medi-Cal, Healthy Families Program, coverage offered through the California Health Benefit Exchange (Covered California), California Children’s Services program, other governmental programs, or charity care, and that these applications will be provided to admitted patients prior to discharge or to patients receiving emergency or outpatient care at the time of service. The hospital shall also provide patients with a referral to a local consumer assistance center housed at legal services offices.

If a patient lacks or has inadequate, insurance, and meets certain low-and moderate-income requirements, the patient will be informed that the patient may qualify for Charity Care or Partial Charity Care. Patients will also be provided with the name and telephone number of a hospital employee or office from whom or which the patient may obtain information about the hospital’s Charity Care and Partial Charity Care policies, and how to apply for that assistance.

Applications

Patients may apply (or reapply) for financial assistance at any time in the collection process including, but not limited to, after collection agency placement. If a patient applies, or has a pending application, for another health care coverage at the same time the patient applies under the hospital’s charity care policies, neither application shall preclude eligibility for the other program.

For purposes of determining eligibility for Charity Care, documentation of assets may include information on all monetary assets, but shall not include statements on retirement or deferred compensation plans qualified under the Internal Revenue Code, or nonqualified deferred compensation plans. The hospitals can require a waiver or release form from the patient or patient’s family authorizing the hospitals to obtain account information from financial or commercial institutions, or other entities that hold or maintain the monetary assets, to verify their value. For purposes of determining eligibility for Partial Charity Care (discounted payment), documentation of income shall be limited to recent pay stubs or income tax returns. Information received from patients in connection with the application for Charity Care or Partial Charity Care (discounted payment) may not be used for collection activities; however, this does not prohibit the use of information obtain by the hospital or its collection agencies independently of the application process for Charity Care or Partial Charity Care (discounted payment).

AHMC staff in the Central Business Office, patient registration, and emergency departments will understand the charity care policy and will be able to direct questions regarding the policy to the proper hospital representative. The hospital staff that regularly interact with patients will also be familiar with the charity care policy, and if necessary, will be able to direct questions regarding the policy to a knowledgeable hospital representatives or departments.

The hospital Financial Counselor or MEP will attempt to identify potential charity care patients at admission or while the patients are in-house.

Financial Counselor/MEP Procedure

The FC/MEP Patient Advocate must screen patients for potential linkage to government/county programs. During the screening for eligibility process, the Advocate should secure the application. The application is used to determine eligibility for Charity Care and Partial Charity Care.Patient Qualification & Eligibility

The criteria for eligibility is based upon a patient’s individual or family income as compared to AHMC scheduled discount based on the current year’s Department of Health and Human Services Federal poverty guidelines. This guideline is reviewed annually, subject to changes in the consumer price index, and is published each year. A financially qualified patient who has family income at or below 200% of the Federal poverty level will be eligible fora 100% (free) discount, with a sliding scale discount for financially qualified patients with an individual or family income from 201% to 500% of the Federal poverty level.

In determining eligibility under the charity care policy, the AHMC hospitals can consider a patient’s income and monetary assets. In order for the hospitals to determine monetary assets, the following assets are excluded: retirement or deferred compensation plans qualified under the Internal Revenue Code or other nonqualified deferred-compensation plans. In determining eligibility, the AHMC hospitals cannot count the first $10,000 of the patient’s monetary assets, nor shall 50% of the patient’s monetary assets over the first $10,000 be counted.

Definition of Income

For the purpose of determining income, all sources of income will be included in the calculation of financial need, including employment income and any unearned income. Self-employment income will be based on the gross receipts as reported on the individual’s last Federal tax return. For purposes of determining eligibility for discounted payment, documentation of income shall be limited to recent pay stubs or income tax returns.Some examples of income

Income includes money wages and salaries before any deductions; gross receipts from non-farm self-employment (including business, professional enterprise, and partnership, before deductions), gross receipts from farm self employment (receipts from a farm which one operates as an owner, renter, or sharecropper, before deductions for farm operating expenses, excluding non - cash expenses); regular payments from Social Security, railroad retirement, unemployment compensation, strike benefits from union funds worker’s compensation, automobile insurance, veteran’s payments, public assistance, (including Temporary Assistance for Needy Families, supplemental security income, emergency assistance money payments, and non-federally funded general assistance, or general relief money payments, and training stipends; alimony, child support, and military family allotments or other regular support from an absent family member or someone not living in the household; private pensions, government, employee pensions (including military retirement pay), and regular insurance or annuity payment; college or university scholarships, grants, fellowships, and assistantships; and dividend, interest, net rental income, net royalties, and net gambling or lottery winnings.

Some examples of what would not be included as income

Capital gains, any assets drawn down as withdrawal from a bank, the sale of primary residence, tax refunds, gifts, loans, lump-sum inheritance, and onetime insurance payments. Also excluded are non-cash benefits, such as the employer-paid or union paid portion of medical insurance or other employee fringe benefits, food or housing received in lieu of wages, the value of food and fuel produced and consumed on farms, the imputed value of rent from owner-occupied, non-farm or farm housing, and such Federal non-cash benefits programs as Medicare, Medi-Cal, Supplemental Nutrition Assistance Program (food stamps), school lunches, and housing assistance.

Definition of Assets

Assets include, but are not limited to, cash, checking accounts, saving accounts, stocks, bonds, certificates of deposit,, cash value of life insurance policies, and equity in property owned.Exemptions to Assets:

The first $10,000 of monetary assets and 50% of monetary assets over the first $10,000.

Primary place of residence.

All personal property including, but not limited to, household goods, and medical equipment.

Assets held in pension plans.

Other assets at our discretion that we may believe are in the patient’s best interest to exempt.

Verificcation of Income and Monetary Assets

For purposes of determining eligibility, patients are responsible to make every reasonable effort to provide information that is reasonable and necessary for the hospital to make a determination. Information required for eligibility determination may include, but is not limited to, the following:AHMC requests patients to attest to the patient’s family income set forth in the patient’s application. In determining a patient’s total income, AHMC may consider other financial assets and liabilities of the patient, as well as patients’ family income, when assessing the ability to pay. If a determination is made that the patient has the ability to pay the patient’s bill, such determination does not preclude a reassessment of the patient’s ability to pay upon presentation of additional documentation (e.g., regarding essential living expenses).

Paycheck stubs are preferable with income listed for the three consecutive months prior to the month the application is received plus statements of all other income received, as defined in the Definition of Income section of this policy. An income statement is recommended for all self-employed persons. In the absence of income, a letter of support and/or declaration of no income can be accepted from the patient and/or responsible party with the letter detailing how the patient’s current living needs are being met.

W-2 FORM OR PAY STUBS

SELF EMPLOYED SCHEDULE C FORMS

MEDICAL ASSISTANCE ELIGIBILITY/DENIAL NOTICE, IF APPLICABLE

SOCIAL SECURITY CHECK STUBS

BANK STATEMENTS, CHECKING AND SAVINGS

WORKERS’ COMPENSATION CHECK STUBS

UNEMPLOYMENT CHECK STUBS

PROOF OF DEPENDENCY MAY BE REQUIRED IN ORDER TO CLAIM A DEPENDENT CHILD

OTHER REASONABLE INFORMATION THAT THE AHMC HOSPITALS MAY DEEM RELEVANT IN ASSISTING THEM IN MAKING THE MOST APPROPRIATE CHARITY CARE DETERMINATION

Failure to provide reasonable and necessary requested information will be grounds for denial of charity care. Income may be verified using information for either the previous 12 months or that is annualized based on partial year information. In addition to historical information, future earnings capacity, along with the ability to meet a patient’s obligations within a reasonable time, may be considered in connection with a patient’s application. Providing false information or excluding requested information may result in denial of application and eligibility. This financial information is considered confidential and is protected to ensure that such information will only be used to assist in enrollment or evaluating eligibility for financial assistance. Furthermore, this information may not be used for collection activities; however, this does not prohibit the use of information obtain by AHMC, the AHMC hospitals or their collection agencies independently of the application process for charity care.

General Application Guidelines

An application, whenever possible, should be submitted and approved before services are provided; however, no application will be required, or financial consideration taken into account, for emergency medical treatment or services that are provided without advance notification from a physician or other referral source. Applications should be completed as soon as possible keeping in mind the patient’s medical needs as the primary focus. Applications to cover emergency treatment will be made after the services are provided.It is crucial that charity care applicants cooperate with AHMC’s and the AHMC hospitals’ need for accurate and detailed information within a reasonable time frame. If information is not legible, or is incomplete, applications may be denied or returned to applicants for revision or supplemental information, subject to management’s discretion.

Upon approval for charity care, the patient’s application and supporting documentation may be used for re-evaluation for future services, along with other updated pertinent supplemental information, for up to six months. Exceptions may be granted during this six-month period based on management’s discretion, taking into consideration any change in circumstances from the time of the initial approval.

Restrictions on Collection Activities by AHMC and the AHMC Hospitals

AHMC and the AHMC hospitals will not use wage garnishment or place a lien on, or notice or conduct the sale of, a qualified charity care patient’s primary residence as a means of collecting unpaid hospital bills.AHMC and the AHMC hospitals will not pursue collection action against a qualified charity care patient who has clearly demonstrated that he or she does not have sufficient income or assets to meet any part of his or her financial obligation.

AHMC and the AHMC hospitals will not use a forced court appearance to require a qualified charity care patient or responsible party to appear in court.

AHMC will not garnish wages for the financially qualified charity care patient.

Once charity care status is determined, it will be applied retroactively to all qualifying accounts.

For an uninsured patient or for a patient who may be a patient with high medical costs, AHMC and the AHMC hospitals shall not report adverse information to a consumer credit reporting agency or commence civil action against the patient for nonpayment for at least 180 days after initial billing.

If an uninsured patient has requested charity assistance and/or applied for other coverage and is cooperating with the hospitals, the hospitals will not pursue collection action until a decision has been made that there is no longer a reasonable basis to believe the patient may qualify for coverage.

Additional Responsibilities for Patients Who Have Received Partial Discounted Charity Care

When a patient has been approved under the charity care policy for partial discount, the AHMC hospitals will work with the patient or the responsible party to establish a reasonable payment option, taking into consideration the patient’s family income and essential living expenses. If the hospital and the patient cannot agree on the payment plan, the hospital shall offer a reasonable payment plan, meaning monthly payments that are not more than 10% of the patient’s monthly family income, excluding deductions for essential living expenses. For purposes of creating a reasonable payment plan, “essential living expenses” means expenses for any of the following: rent or house payment and maintenance, food and household supplies, utilities and telephone, clothing, medical and dental payments, insurance, school or child care, child or spousal support, transportation and auto expenses, including insurance, gas, and repairs, installment payments, laundry and cleaning, and other extraordinary expenses.If a patient complies with a payment plan that has been agreed upon by the AHMC hospital, the AHMC CBO will not pursue collection action.

An extended payment plan may be declared no longer operative after the patient’s failure to make all consecutive payments during a 90-day period. Before declaring an extended payment plan no longer operative, the hospital shall: (1) make a reasonable attempt to contact the patient by phone and to give notice in writing that the extended payment plan may become inoperative, and of the opportunity to renegotiate the extended payment plan; and (2) if requested by the patient, attempt to renegotiate the terms of the defaulted extended payment plan. The hospital, or its collection agency, shall not report adverse information to a consumer credit reporting agency or commence a civil action against the patient or responsible party for nonpayment prior to the time the extended payment plan is declared to be no longer operative. The telephone call and notice provided for above may be made to the last known telephone number and address of the patient.

Collection Policy

Accounts will not be sent to a collection agency if the patient is attempting in good faith to settle the account by negotiating a payment plan or is making regular partial payments. Any extended payment plans negotiated with a qualified patient under the discounted fee arrangement must be provided without interest so long as the patient does not default on their payment arrangement.Any extended payment plans negotiated with a qualified patient under the discounted fee arrangement must be provided without interest so long as the patient does not default on their payment arrangement.

If a patient is appealing a denial of insurance coverage or payment and is making a reasonable effort to keep the AHMC hospital informed of the patient’s appeal, the account should not be reported to a consumer credit reporting agency until a final determination is made on the appeal. In any

event, for an uninsured patient or for a patient who may be a patient with high medical costs, AHMC and the AHMC hospitals shall not report adverse information to a consumer credit reporting agency or commence civil action against the patient for nonpayment for at least 180 days after initial billing.

Accounts may be sent only to collection agencies that have been provided with, and have agreed in writing to abide by, the hospital’s standards and scope of practices for the collection of debt.

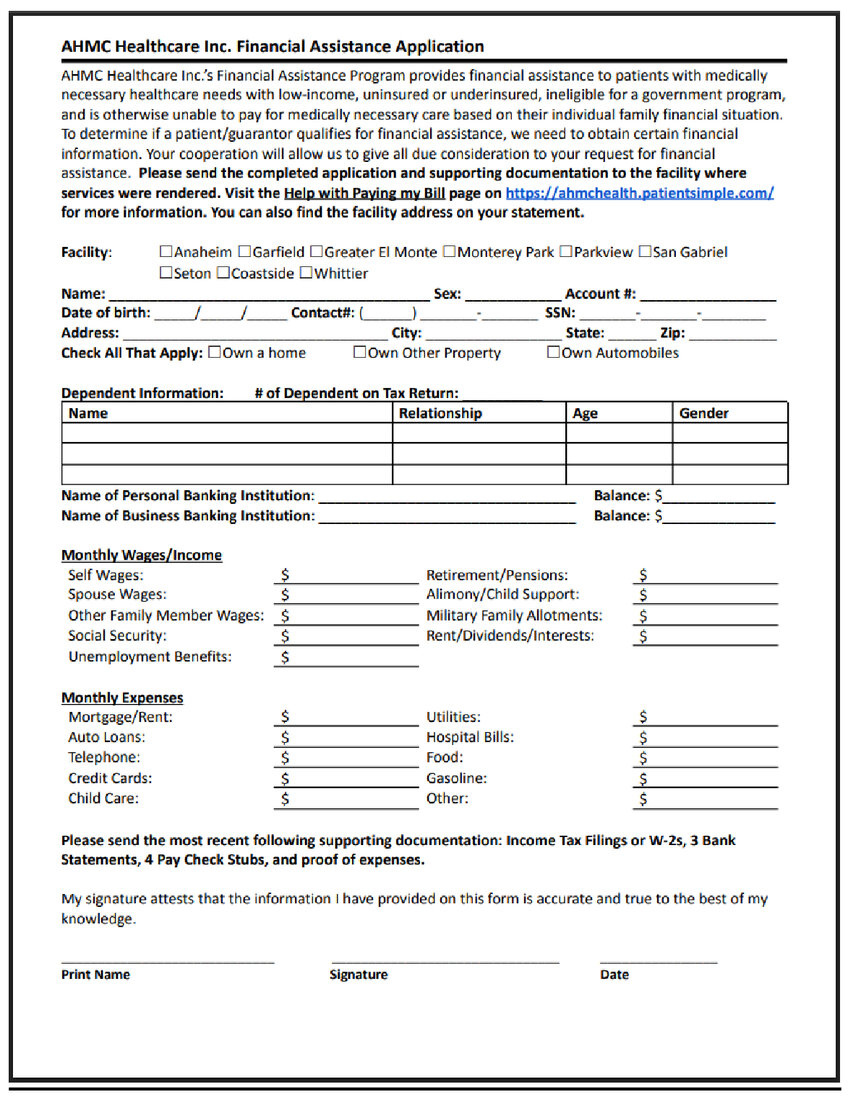

Application Process

A completed AHMC Charity Care application (see attached Exhibit) will be processed by the hospital’s admitting department, MEP worker, Financial Counselor or CBO staff in accordance with the Revenue Cycle/Patient Financial Services policy. When the AHMC Charity Care application is received, the front line staff will review and determine whether the application is complete and whether the documentation supports eligibility for Charity Care or Partial Charity Care.The MEP/FC worker is responsible to verify that all figures used to calculate eligibility are correct, and if needed, they have authority to seek additional verification before submitting the application for approval. The CFO will evaluate the recommendations, verify calculations and documentation and either approve, deny, or forward the application to the appropriate person (DPS) for further consideration as may be necessary.

Patients who are provided Partial Charity Care in the form of a discount must sign a written agreement to pay the amount of the hospital bill remaining after deducting the discount. The patient will receive a bill showing charges, the amount of the discount and the amount due. Professional services provided by physicians and other services provided by outside vendors are not covered by this policy. Patients seeking a discount for such services should contact the physician or outside vendor directly. Patients should also be informed that emergency physicians who provide emergency medical services in the hospital are required by law to provide discounts to uninsured patients or patients with high medical costs who are at or below 400% of the Federal poverty level. This statement shall not be construed to impose any additional responsibilities upon the hospitals.

Patients who do not provide the requested information necessary for the hospital to completely and accurately assess their financial situation in a timely manner and/or who do not cooperate with efforts to secure governmental health care coverage will not be eligible for Charity Care or Partial Charity Care.

This policy is available in English, Spanish, and Chinese. The written notices of Charity Care and Partial Charity Care will be posted in the Emergency Room, Central Business Office, Outpatient Services, and Admitting Department where patients are presented for services.

To obtain more information on how to apply for Charity Care or Partial Charity Care, patients should contact a hospital MEP worker for assistance.

Revenue Classification

It will be the responsibility of the Business Office to maintain the integrity of account classification on the hospital’s patient accounting system. Prior to month-end close, MEP is responsible for providing a detailed report listing critical changes in account class between self-pay and charity care for any AR account assigned in-system (CPSI). The Business Office is required to use those reports to update the changes in the patient accounting system prior to the month-end.Critical changes in account class are defined as:

Any account originally assigned to MEP as self-pay that is re-classed as a result of meeting the criteria for Charity Care or Partial Charity Care (a patient with high medical costs) patients.

Any account originally assigned to the CBO as Charity Care or Partial Charity Care that is re-classed to self-pay as a result of denying charity care.

Maximum Out-of-Pocket

As outlined in the hospital’s charity care guidelines, a maximum out-ofpocket payment will be applied to all patients whose income falls within the hospital’s guidelines.Patient or family out-of-pocket medical expenses will not exceed 10% of the patient’s family income (excluding deductions for essential living expenses) within a 12-month period, if the patient’s family income is less than 400% of the Federal poverty level.

Denied Charity Care Recommendations

In the event the CFO denies a patient’s application for charity care, documentation is to be placed in the hospital’s collection system explaining the reasons for the rejection of the application. The CFO is also to indicate on the Confidential Financial Application the reason for denial and the date of the denial. The packet is then to be forwarded to DFS for review. After an initial review and discussion with the CFO, for those patient accounts where disagreement still prevails, and the accounts that meet AHMC guidelines for Charity Care as set forth here, a denial summary will be sent to the respective AHMC Corporate Vice President of Finance for resolution. For those patient accounts that the CFO of facility has denied that have met the AHMC charity care guidelines as set forth here, a denial summary will be sent to the respective VP, Corporate Office.AHMC Heath Care Inc.

500 E Main Street

Alhambra, CA 91801

Attention: Director of CBO

In the event that a patient disputes an eligibility determination, the patient may seek review from the CFO or other designated hospital representative.

Third Party Payer Language

Charity care will be granted on an “all, partial, or nothing” basis. There is a category of patients who qualify for Medi-Cal, but who do not receive payment for their entire stay. Under the charity care policy, these patients are eligible for charity care write-offs. These write-offs do not include Share of Cost (SOC) amounts that the patient must pay before the patient is eligible for Medi-Cal. In addition, the hospital specifically includes as charity care the charges related to denied stays, denied days of care, and non-covered services. These Treatment Authorization Request (TAR) denials and any lack of payment for non-covered services provided to Medi-Cal patients are to be classified as charity care. These patients are receiving the service, and they do not have the ability to pay for it. In addition, Medicare patients who have Medi-Cal coverage for their co-insurance/deductibles, for which MediCal does not make payment, and for which Medicare does not ultimately provide bad debt reimbursement, will also be included as charity care. These patients are receiving a service for which a portion of the resulting bill is not being reimbursed.Emergency Physicians

Emergency physicians who provide emergency medical services in a hospital that provides emergency care are also required by law to provide discounts to uninsured patients or patients with high medical costs who are at or below 400% of the Federal poverty level. This statement shall not be construed to impose any additional responsibilities upon the AHMC hospitals.Custodian of Records

FC will serve as the custodian of records for all charity care documentation for all accounts identified by CBO, MEP, and DPS.APPROVAL PROCESS:

Charity Care assistance must be approved by the hospital’s CEO/CFO2025 Federal Poverty Guidelines

UP to 500% FPL = Discount to Medicare DRG RATE

Up to 200% FPL = 100% Charity Write Off

*Patients who qualify for Charity services but are >200% FPL will be given a 60% discount for outpatient services.

Self-Pay Patient Discounts Eligibility Requirements:

1. A patient who does NOT qualify for charity care under the charity care program and who does not have insurance or who has inadequate insurance coverage and are considered “Self Pay” will be eligible for a prompt payment discount.2. A patient who qualifies for a prompt payment discount must make a full deposit of estimated charges at the time of or prior to receiving services in order to qualify for the prompt payment discount.

3. If a patient makes other payment arrangements, the patient will be billed for the remainder of the patient’s balance due and the balance must be paid in full within 30 days of receipt of the bill. If payment is not received within 30 days, the prompt payment discount will be rescinded and the full billed charges will be due and payable upon receipt of the bill.

4. Cosmetic procedures are excluded from the prompt payment discount program.

5. Discount payments require full payment at the time of service or within 30 days after discharge or the date of service unless other arrangements have been made.

SELF–PAY DISCOUNT

1. 40% OFF charges for payment received under the self-pay discounts requirement -- see above.

2. AHMC considers APC calculation at 130%

Exhibit - Financial Application

English Financial Assistance Application -

https://ahmchealth.patientsimple.com/shared/sites/ahmchealth/static/AHMC_Healthcare_FAA_English.pdf

Spanish Financial Assistance Application -

https://ahmchealth.patientsimple.com/shared/sites/ahmchealth/static/AHMC_Healthcare_FAA_Spanish.pdf

Revised date: 1/23/2025